All Categories

Featured

Table of Contents

Some items have specific health and wellness issues that are seen extra positively by a details provider. There are carriers that will certainly release policies to more youthful adults in their 20s or 30s that can have persistent problems like diabetes mellitus. Normally, level-benefit typical final expense or streamlined concern whole life plans have the most affordable costs and the biggest accessibility of additional riders that clients can add to plans.

Depending on the insurance carrier, both a favored rate class and common rate course might be supplied. A customer in outstanding wellness without current prescription medications or wellness problems might receive a favored price course with the most affordable costs feasible. A client healthy despite having a couple of upkeep medications, yet no significant wellness issues might get conventional rates.

Just like various other insurance items, what your clients will certainly spend for a final expenditure insurance plan relies on the carrier, plan, and state. Your customer's health, sex, and age can additionally be significant consider identifying their costs(s). Similar to various other life insurance policy plans, if your customers smoke, utilize various other kinds of cigarette or pure nicotine, have pre-existing health and wellness conditions, or are male, they'll likely have to pay a higher price for a final cost policy.

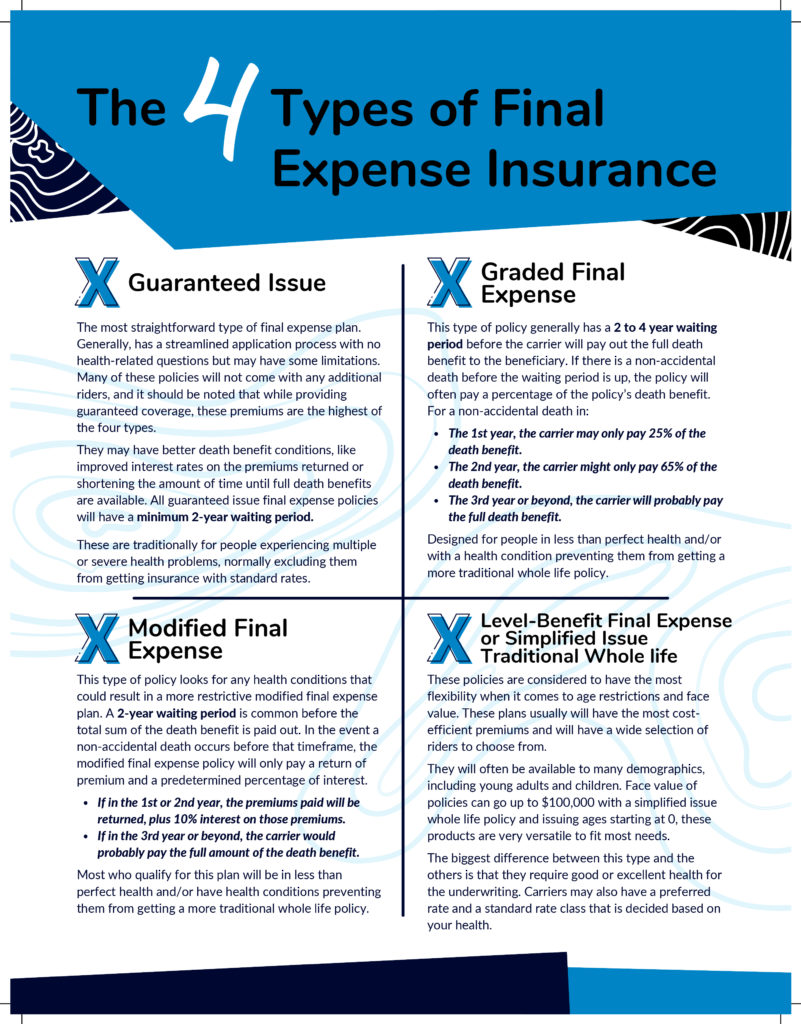

At a lot of, applicants need to answer health and wellness and prescription medication concerns and/or complete a telephone interview. Simply put, there's little to no underwriting called for! That being said, there are 2 primary kinds of underwriting for last cost plans: simplified concern and ensured concern. With streamlined concern plans, clients typically only have to address a couple of medical-related concerns and might be denied coverage by the service provider based on those responses.

For one, this can enable agents to identify what type of plan underwriting would function best for a particular customer. And two, it helps representatives limit their client's alternatives. Some carriers may disqualify clients for insurance coverage based on what drugs they're taking and how much time or why they have actually been taking them (i.e., maintenance or treatment).

Funeral Plan Quote

This survivor benefit is typically related to end-of-life expenses such as clinical expenses, funeral costs, and extra. Choosing a final expense insurance policy option is one of the numerous actions you can require to prepare your family members for the future. To assist you better comprehend the ins and outs of this kind of entire life insurance plan, allow's take a more detailed look at how final expense insurance policy functions and the types of plans that may be available for you.

Not every final expenditure life insurance coverage policy is the very same. An immediate or standard last cost insurance coverage policy enables for recipients to obtain complete death advantages no matter when or just how the insurance holder died after the start of the insurance coverage plan.

For example, a graded benefit plan may have it to ensure that if the insured passes throughout the very first year of the plan, approximately 40 percent of the advantage will be provided to the recipients. If the insured dies within the second year, approximately 80 percent of the benefits will certainly most likely to the recipients.

An assured problem final cost insurance coverage needs a two- to three-year waiting period prior to being eligible to receive advantages. If the insured individual die prior to the end of this waiting duration, the recipients will not be qualified to get the survivor benefit. Nonetheless, they may get a return of the premiums that have actually been paid with rate of interest.

Burial And Final Expense Insurance

Relying on your health and wellness and your funds, some policies might be better fit for you and your family over the other options. As a whole, last cost life insurance coverage is fantastic for anyone seeking an economical plan that will help cover any impressive balances and funeral costs. The price of premiums has a tendency to be lower than traditional insurance plan, making them fairly cost effective if you are trying to find something that will fit a limited spending plan.

An instant final expense policy is a good option for anyone that is not healthy since beneficiaries are qualified to get benefits without a waiting period. A study on the wellness and case history of the insurance holder may establish just how much the costs on this plan will certainly be and influence the survivor benefit quantity.

Somebody with major health and wellness problems can be refuted various other kinds of life insurance coverage, but an ensured concern plan can still provide them with the insurance coverage they need. Getting ready for end-of-life expenses is never a pleasurable conversation to have, however it is one that will certainly assist your family when dealing with a hard time.

Instant Final Expense Quotes

Final cost insurance policy supplies benefits however requires mindful consideration to determine if it's appropriate for you. Life insurance policy for last expenditures is a kind of long-term life insurance made to cover costs that develop at the end of life.

According to the National Funeral Supervisors Association, the ordinary price of a funeral service with interment and a viewing is $7,848.1 Your enjoyed ones might not have access to that much cash after your death, which could include in the stress and anxiety they experience. In addition, they may run into various other prices connected to your passing.

Last expenditure protection is sometimes called interment insurance coverage, yet the cash can pay for basically anything your enjoyed ones require. Beneficiaries can make use of the fatality advantage for anything they need, allowing them to attend to the most pressing economic top priorities.

Funeral Insurance For Under 50

: Work with experts to aid with managing the estate and navigating the probate process.: Shut out make up any end-of-life treatment or care.: Repay any type of various other debts, including auto financings and credit cards.: Recipients have full discernment to use the funds for anything they require. The cash could also be made use of to create a heritage for education and learning expenditures or contributed to charity.

Last expenditure plans are typically irreversible, meaning they stay active as long as you remain to pay the prices of insurance coverage. That's important when protection needs to last for as long as you live. In lots of instances, you get streamlined issue insurance policy without the need for a complete clinical testimonial.

Acting quickly may be in your benefit. Furthermore, one of the most charitable policies (occasionally called "ensured problem") could not pay a fatality benefit if you pass away of certain diseases during the initial 2 years of protection. That's to protect against individuals from buying insurance instantly after finding an incurable illness. This insurance coverage might still cover fatality from mishaps and other reasons, so study the alternatives available to you.

When you aid relieve the economic concern, family and good friends can concentrate on taking care of themselves and preparing a meaningful memorial as opposed to rushing to locate money. With this kind of insurance policy, your recipients might not owe taxes on the fatality benefit, and the cash can approach whatever they need many.

Latest Posts

Final Expense Protection Plan

Difference Between Life Insurance And Final Expense

Metlife Burial Insurance